rsu tax rate india

Indian company also has calculated perquisite based on FMV on total number of stocks including withheld stocks and properly deducted TDS 309 and remitted the TDS and issued Form 16 for FY2018-19 and it is properly reflecting in Form 16 Part A and Part B. How Are Restricted Stock Units RSUs Taxed.

Tax Planning For Stock Options.

. The beauty of RSUs is in the simplicity of the way they get taxed. Please note that if your RSU income is taxed above 22 when your taxes are filed depending on your other tax withholdings you. On the day if vesting 30 of the amount stocks are withheld and paid as tax to Indian Gov.

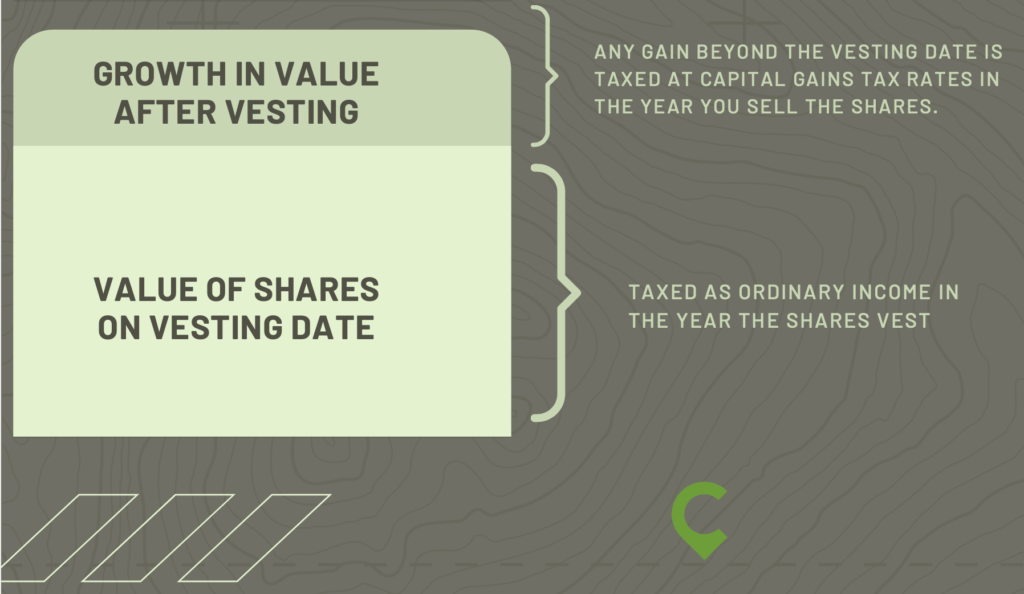

RSU Tax Rate. Upon vesting your stocks fair market value is taxed at the same rate as your ordinary income. So RSUs are taxed twice.

Related

LOG IN or SIGN UP. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. What is the tax rate for an RSU.

Companies sometimes grant RSUs to their employees in a phased manner such as 25 RSU every year. On etrade we have option to sell only ESPP or only RSU. Sale of Immovable Property.

How to file. In case you have. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate.

Unlike the much more complicated ESPP they get taxed the same way as your income. This happens over time through a vesting schedule. Tax on US Stocks in India.

When preparing taxes in 2021 her actual tax due from RSUs is 37000 37 ordinary income tax rate 100000 Tax surprise - Since funds from her RSUs redemptions were withheld at the 22 supplemental rate she has to come up with an additional 15000 out-of-pocket to pay her taxes due on April 15th. The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at source is deducted in India TDS on the market value of the RSU on the date they become vested in your hands say for eg the market price on that day in Indian rupees as 100 so the TDS 30 assuming that your. Since RSUs are not a capital asset or financial or equity interest until vested these can be reported as part of other assets in schedule FA in your income tax return.

Hello Generally there is no double taxation since US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes. Federal Income Tax Brackets and Tax Rates. 20 ESPP shares vested on 1 Jan 2017 20 RSU vested on 30 Mar 2017.

How does a DTAA work. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Tax on Bitcoin in India.

About 6522 value is consumed in tax. How it works in Google MicrosoftAdobeAmazon Walmart and what will be effective tax on allocated RSUs. So you have to pay tax on all Rs 1 lac however if its RSU of a public listed Indian company your tax will be NIL because of long term capital gains but if its a out side india listed company then 20 of 1 lac which is Rs 20000.

RSUs offer several benefits to a companys employer and employees. You will need proof of the payment of foreign tax. Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option.

The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at source is deducted in India TDS on the market value of the RSU on the date they become vested in your hands say for eg the market price on that day in Indian rupees as 100 so the TDS 30 assuming that your. RSU taxability in India. What are the taxation rules for RSUs in India.

Applicable Tax Rates. Here is an article on employee stock options. Boosts morale and pushes them to perform to the best of their abilities.

The tax rates vary depending on whether the shares are a listedan unlisted company. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. In case a company is granting 200 RSUs with a condition of 25 RSU vesting every year then 25 50 shares can be claimed at the end of the first year.

For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift. Listed below are some of the benefits of restricted stock units you need to consider. 30 of G stocks in India.

Encourages an employee to remain as part of an organisation for a prolonged period. For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock.

RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. A Guide to Property Registration in India 145638 Here is how to merge multiple EPF UAN numbers or. For 2022 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million.

The stock is restricted because it is subject to certain conditions. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. Once vested Foreign Stocks earlier RSUs must be reported as part of financial interest in a foreign entity in your tax return.

Your tax rate will depend on your specific tax bracket based on your income. Deductions under Income tax. However if there double taxation you can get the credit of foreign tax deducted while filing our income tax return.

Individual tax rates. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Restricted stock is a stock typically given to an executive of a company.

When you have incurred a loss.

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

How Are Esops Rsus Taxed In India Aditi Bhardwaj Co

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

What Happens To Rsus When You Quit Equity Ftw

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Income Tax Implications On Rsus Or Espps